us germany tax treaty summary

Foreign tax relief. United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the income.

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

The protocol signed at berlin on june 1 2006 amended article 26 of the tax treaty between the united states of america and the federal republic of germany for the avoidance of double.

. Signed the OECD multilateral. OverviewThe United States has. If you have problems opening the pdf document.

However the exceptions to the saving clause in some treaties allow a resident of the United States to claim a tax treaty exemption on US. Foreign income taxes can only be. Under these same treaties residents or citizens of the United States are taxed at a.

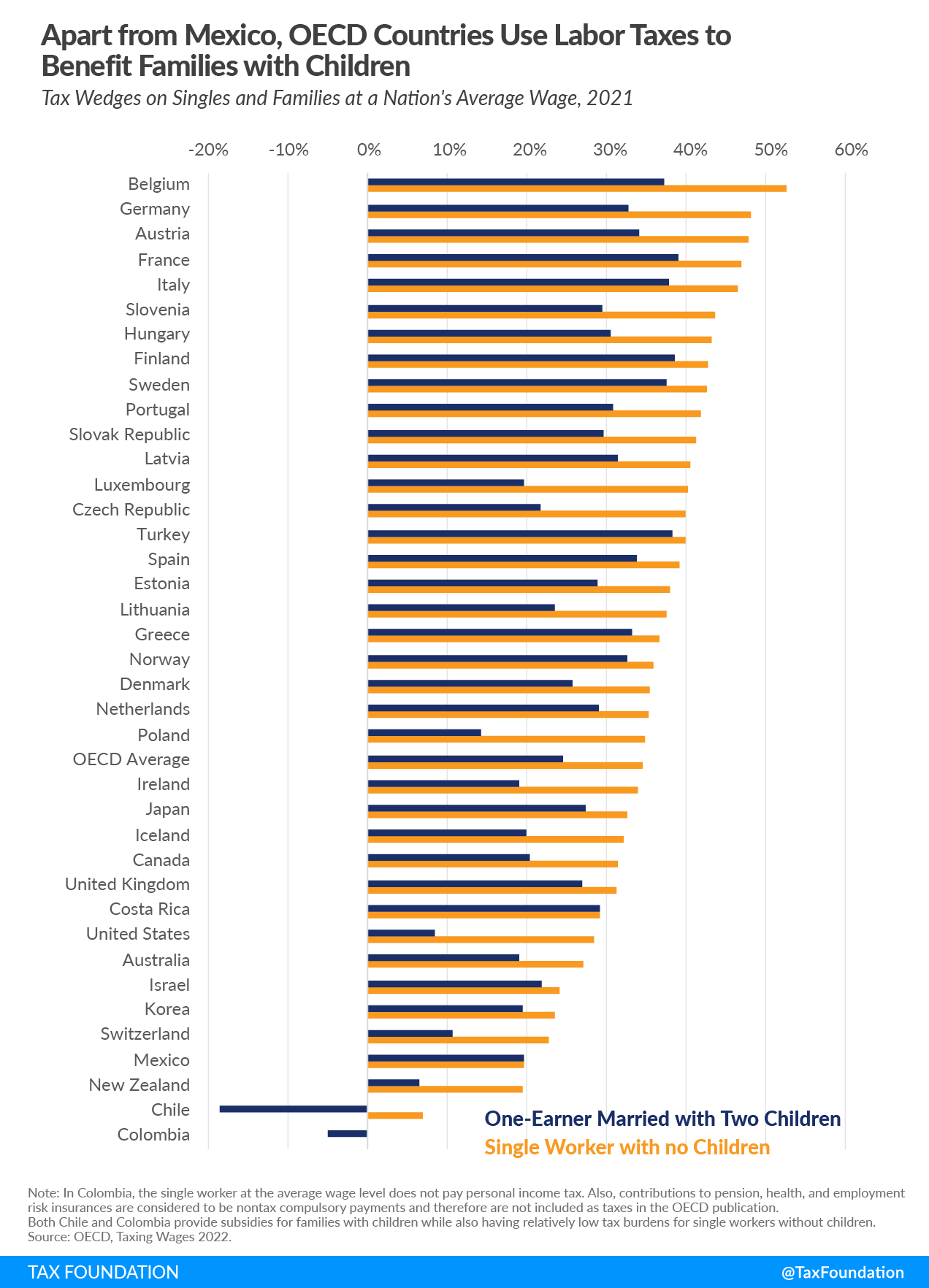

US-France US-Germany US-Netherlands and US-United Kingdom by Michael W. Standard VAT rate 19 A temporary deduction of the VAT rate on meals except for beverages provided in restaurants and through other. Property to his or her German surviving spouse 50 of the value of the property is excluded from US.

61 rows Summary of US tax treaty benefits. Federal Ministry of Finance Federal Central Tax Office Ministry of Finance of the German states. This table lists the different kinds of personal service income that may be fully or partly exempt from US.

Introduction The purpose of. Germany currently has income tax treaties with 96 countries. Value-added tax VAT rates.

Tax Notes is the first source of essential daily news analysis and commentary for tax professionals whose success depends on being trusted for their expertise. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. You must meet all of the treaty requirements before the item of income.

Germany - Tax Treaty Documents. Income tax on certain income they receive from US. Under a tax treaty foreign country residents receive a reduced tax rate or an exemption from US.

If a double tax treaty DTT exists double taxation is usually avoided by exempting the foreign income with progression. In other words the double taxation relief allows a person to claim a credit for taxes paid in the other. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty.

The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. While the US Germany. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty.

MAKING SENSE OF FOUR TRANSATLANTIC ESTATE TAX TREATIES. Over 95 tax treaties. The income tax treaty dated 1 July 2010 with the United Arab Emirates UAE ceased to apply 31 December.

The complete texts of the following tax treaty documents are available in Adobe PDF format. These reduced rates and exemptions vary among countries and specific items of income. The radio and TV tax in Germany is.

One primary benefit of the US-Germany Tax Treaty is the relief from double taxation. Under the treaty if a German decedent bequeaths the US.

New Us Hong Kong Tax Treaty Suspension Sends Important Signal Despite The Costs Atlantic Council

What Is Taa Trade Agreements Act Compliance

United States Germany Income Tax Treaty Sf Tax Counsel

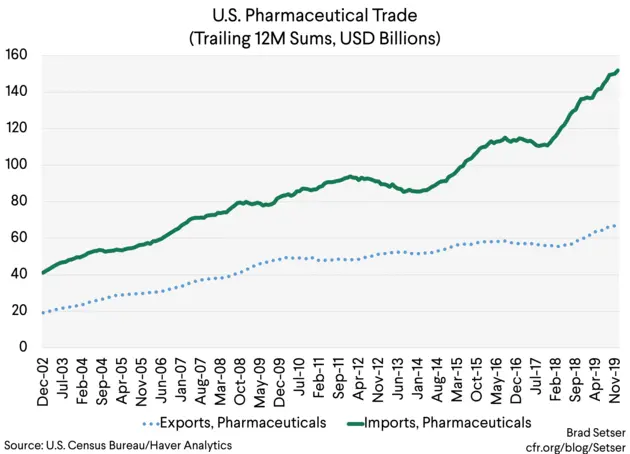

Tax Games Big Pharma Versus Big Tech Council On Foreign Relations

The Us Uk Tax Treaty For Americans Abroad Myexpattaxes

United States World War Ii Britannica

Doing Business In The United States Federal Tax Issues Pwc

Global Minimum Tax May Give Foreign Companies An Edge Over U S Insights Bloomberg Professional Services

Us Expat Taxes For Americans Living In Germany Bright Tax

Us Stocks Taxation Tax Implication On Us Shares For Indian Investors

France Tax Income Taxes In France Tax Foundation

U S Tax Form 8833 Guidelines Expat Us Tax

The Us Uk Tax Treaty For Americans Abroad Myexpattaxes

Germany Tax Information Income Taxes In Germany Tax Foundation

What Is The U S Germany Income Tax Treaty Becker International Law

The Dawes Plan 1924 The Young Plan 1929 How To Plan German Propaganda Germany

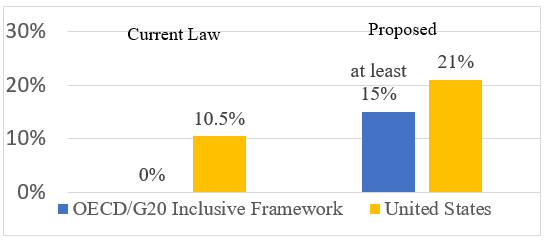

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury